Navigating the intricacies of the finance market requires not only knowledge but also strategic insight. Investors, whether seasoned or new, benefit significantly from expert advice finance that distills complex market behaviors into actionable strategies. Understanding market mechanisms, analyzing trends, and applying disciplined techniques are essential for achieving sustainable growth and long-term success. This guide provides valuable market guide insights to empower smart decision-making and enhance investment outcomes.

Understanding the Core of Financial Markets

At its essence, the finance market is a platform for the allocation of capital between investors and enterprises. It includes stocks, bonds, commodities, currencies, and derivatives, each with unique characteristics and risk profiles. Stocks provide equity ownership and growth potential, while bonds offer predictable income streams. Derivatives, including options and futures, serve as tools for hedging and risk management. Gaining a firm grasp of these instruments is fundamental for implementing expert advice finance effectively.

Markets are influenced by economic indicators, corporate performance, geopolitical events, and investor sentiment. Monitoring these variables is critical for identifying opportunities and mitigating risks. By utilizing structured market guide insights, investors can develop a clearer understanding of market dynamics and make informed, confident decisions.

Key Principles from Experts

- Diversification is Crucial: Spreading investments across asset classes, sectors, and geographies minimizes exposure to risk. Experts emphasize balancing growth-oriented and income-generating assets to maintain portfolio stability.

- Research and Analysis: Conducting thorough fundamental and technical analysis allows investors to evaluate both intrinsic value and market momentum. Regularly reviewing financial statements, industry reports, and economic forecasts ensures well-informed positioning.

- Discipline and Patience: Market fluctuations are inevitable. Expert investors recommend avoiding impulsive decisions and adhering to long-term strategies to achieve growth hacks ideas that compound over time.

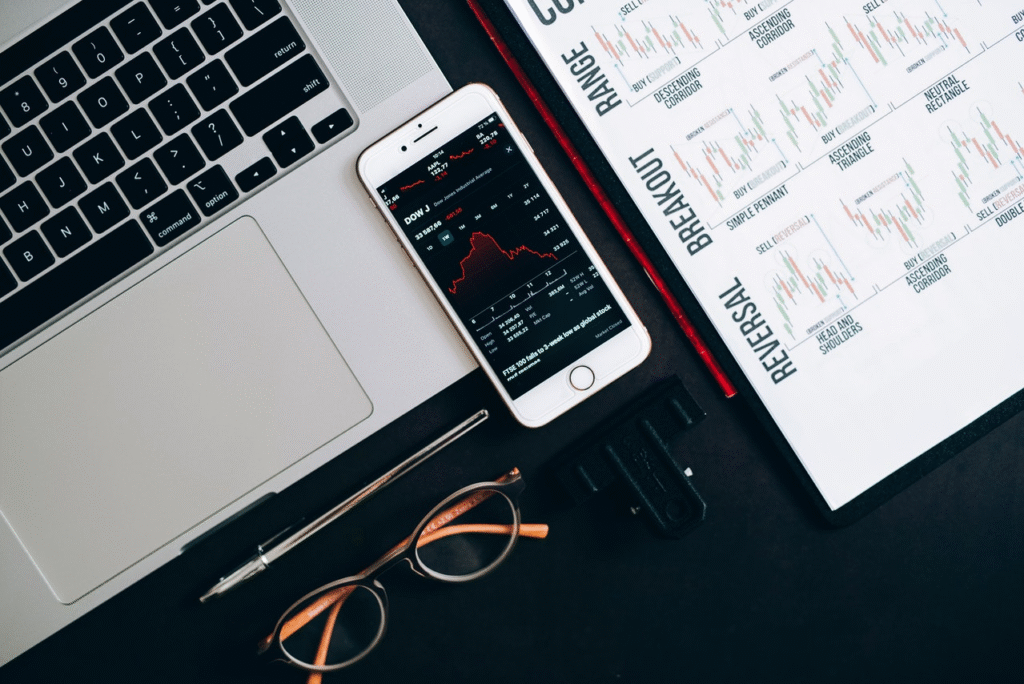

- Leverage Technology: Modern platforms offer real-time data, predictive analytics, and AI-driven tools that enhance strategic execution. Integrating technology into investment routines aligns with smart investor tips and increases the ability to react to dynamic market conditions.

Understanding Risk and Reward

Every investment involves risk, but informed investors can manage it effectively. Risk assessment includes analyzing market volatility, liquidity, and macroeconomic factors. Experts suggest using strategies such as hedging, stop-loss orders, and tactical asset allocation to mitigate potential losses. Following market guide insights on risk management allows investors to pursue higher returns without exposing their portfolios to unnecessary danger.

Behavioral factors also influence market outcomes. Emotional reactions, such as fear or overconfidence, often amplify price swings. Recognizing these psychological patterns helps investors act rationally. By integrating smart investor tips, individuals can maintain discipline and make decisions based on data rather than impulse.

Sector and Trend Analysis

Successful investors often focus on sector-specific dynamics and emerging trends. Technology, healthcare, renewable energy, and consumer goods demonstrate distinct growth potential under varying economic conditions. Monitoring sector performance and understanding macro trends provides a competitive advantage. Using market guide insights helps identify industries poised for expansion, allowing investors to align their portfolios with evolving opportunities.

Experts also emphasize the importance of global market awareness. International trade, regulatory policies, and geopolitical developments can significantly influence domestic and foreign investments. Keeping abreast of these changes ensures proactive positioning and minimizes exposure to unforeseen disruptions.

Practical Steps for Investors

- Implement expert advice finance by establishing a diversified portfolio tailored to individual goals and risk tolerance.

- Utilize market guide insights to evaluate sectors, track trends, and stay informed about economic indicators.

- Apply smart investor tips such as regular portfolio review, disciplined entry and exit strategies, and continuous learning.

- Incorporate growth hacks ideas like leveraging technology, monitoring behavioral trends, and using predictive analytics to enhance decision-making.

- Maintain a long-term perspective, focusing on consistent growth rather than short-term speculation.

The Role of Continuous Learning

Financial markets are constantly evolving, influenced by technological innovation, regulatory changes, and global events. Experts recommend ongoing education to remain competitive. Participating in seminars, reading authoritative publications, and following market analyses provides investors with updated market guide insights. Continuous learning also strengthens the ability to interpret complex data, anticipate shifts, and implement effective growth hacks ideas.

Achieving success in the finance market requires more than intuition; it demands strategic thinking, disciplined execution, and informed decision-making. Following expert advice finance enables investors to navigate complexity with confidence, while market guide insights offer actionable intelligence for evaluating opportunities. Incorporating smart investor tips and growth hacks ideas allows individuals to optimize portfolios, manage risk, and achieve sustainable results. By combining education, analysis, and strategic application, investors can position themselves to thrive in the dynamic world of financial markets.