[ad_1]

Li Huixiang, a house broker in the central Chinese city of Zhengzhou, experienced been searching forward to a bumper March. In an hard work to strengthen the city’s flagging home sector and the nearby economic climate together with it, municipal officials unveiled an array of incentives, which include reduced mortgage loan prices and funds subsidies for new property prospective buyers.

But Li, commonly a star agent at 1 of the biggest household developments in Zhengzhou, has sold only five apartments at Sunac Town because the measures ended up declared — a portion of his normal sales volume.

“The stimulus steps are not ample to offset detrimental elements that are exhibiting very little indicator of easing,” Li mentioned, citing factors like journey constraints related to Covid-19 and slipping household incomes.

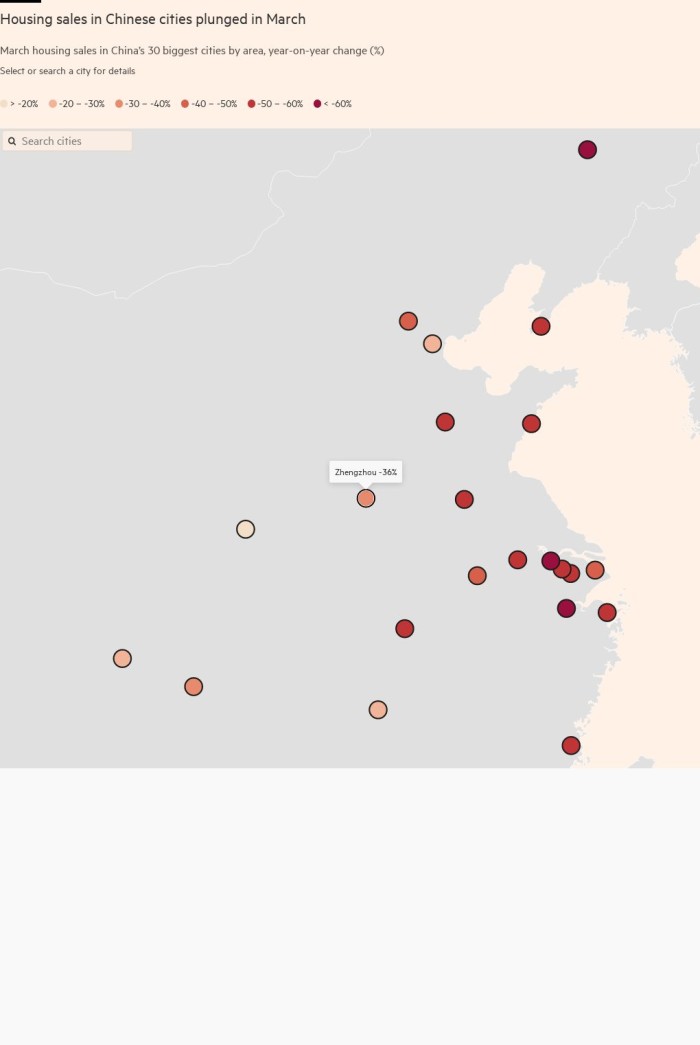

When compared with the exact period of time past yr, new home income in Zhengzhou fell more than 30 per cent in the 6 months from March 1 to mid-April, mirroring a nationwide pattern.

The city, the provincial capital of Henan province and just 2.5 hours south of Beijing by substantial pace rail, necessitates all arrivals to quarantine for 3 times. Li and other brokers mentioned the stream of house prospective buyers from other cities or provinces, who utilized to account for extra than half of their product sales, experienced arrive to a halt.

“There is a conflict concerning boosting housing income and next Covid-prevention guidelines,” stated Li.

There have also been disruptions inside of Zhengzhou, which is home to 12.6mn individuals and not long ago sealed off a substantial space exactly where its airport and massive factories supplying Apple are located.

Authorities also contacted individuals whose cellular mobile phone information indicated that they experienced frequented the area right before its lockdown, inquiring them to quarantine for seven days.

The Xi administration has designed it clear that, the hardship of men and women in Shanghai and other lockdown-affected cities notwithstanding, Covid containment will continue being its leading priority. Shanghai’s lockdown was initially supposed to be partial and final for no much more than 10 days, but has been extended indefinitely.

On Monday the Countrywide Bureau of Stats stated housing design starts off had fallen 20 for each cent in the initially quarter, compared with the very same period very last year, even though at the very least 60 other cities have applied assets assistance steps similar to Zhengzhou’s.

While the NBS estimated that to start with-quarter financial output expanded at a stronger than anticipated 4.8 per cent, March facts pointed to the beginning of a substantial downturn as Shanghai and dozens of other metropolitan areas started to enforce lockdowns to have virus outbreaks and uphold President Xi Jinping’s contentious “zero-Covid” policy.

The strictest lockdowns have been concentrated in the Yangtze river delta around Shanghai, gumming up logistics in one particular of the country’s most crucial manufacturing and export regions, but Zhengzhou has been impacted too.

China’s central lender has experienced a few possibilities to minimize different curiosity charges considering that April 15, but chose to leave all 3 fees unchanged. Its only nod to policy easing this month has been a lesser than anticipated, 25 foundation-point slice in banks’ reserve necessity ratio.

A single Beijing-primarily based govt policy adviser, who requested not to be named, stated that even ahead of Covid lockdowns began proliferating in March, “the top leadership experienced underestimated the effects of the genuine estate meltdown on the broader economy”.

“The predicament,” he included, “may get worse prior to it gets much better.”

Zhengzhou’s residence stimulus deal, a person of the most intense in the nation, was considered necessary to rescue the sector from a disastrous 2021. According to formal facts, new house income in the city fell by a 3rd very last 12 months though land income, a large resource of fiscal revenue, dropped by a quarter.

In addition to Xi’s crackdown on highly leveraged builders, very last year Zhengzhou’s financial system was also hit by two Covid lockdowns and a serious flood that bankrupted modest enterprises and contributed to a surge in unemployment.

“[Local governments] have been struggling with increasing expenditure specifications, in particular in the social sphere, but a income foundation that has been flat,” stated Bert Hofman, head of the Countrywide University of Singapore’s East Asian Institute. “They are seriously squeezed.”

On March 1, Zhengzhou began to roll back actions released to suppress speculative shopping for — in retaining with Xi’s mantra that “homes are for living in, not speculation”. Under the looser rules, the down payment ratio for 2nd-house customers was slashed to 30 for each cent from 60 per cent and they could qualify for home loans priced at 4.9 for every cent, as opposed with 6 for every cent earlier.

City officers also decreased the time customers experienced to wait around ahead of they could sell their households to one 12 months from 3 a long time, and made available subsidies to those people with college levels.

“We are executing all the things, including permitting a moderate degree of speculation, to convey the market place back again to lifetime,” reported a Zhengzhou housing formal.

Opposite to Xi’s intention of marketing “common prosperity” and lessening China’s stark socio-economic divide, the measures boosted luxury residence product sales but did minor for middle-class prospective buyers.

“There is no lack of prosperous prospective buyers who comprehend the value of real estate expenditure,” reported Lucy Wang, a revenue agent at a large-conclude enhancement in Zhengzhou’s northern outskirts. Wang marketed 15 residences, just about every costing more than Rmb8mn ($1.25mn), soon after the actions ended up introduced.

Mass market builders, nonetheless, are nevertheless struggling to attract prospective buyers throughout the place, even with value cuts or inducements these as cost-free parking areas. Nationwide, households’ discounts increased 17 for every cent in excess of the initial a few months of this year even though their new credit card debt, composed mainly of mortgages, fell 46 for each cent.

Marketing workers at 7 small and medium-priced progress jobs in Zhengzhou informed the Financial Instances that they were not conference their month-to-month sales targets. The metropolis is littered with dozens of stalled tasks abandoned by bankrupt builders.

“People are fearful of entering the market when they are surrounded by unfinished structures constructed by distressed builders,” stated an formal at the Zhengzhou department of China Merchants Assets, a Shenzhen-centered team.

Just one would-be customer obtaining next uncertainties is Zhang Jian, a Zhengzhou engineer who last 7 days pulled out of a Rmb1.2mn obtain of a property constructed by State Backyard garden, China’s largest authentic estate team by sales. “I am going to wait for the sector to weaken more,” he claimed.

Extra reporting by Andy Lin in Hong Kong

[ad_2]

Supply link

More Stories

Why Not Be Your Own Pet Insurance Company?

Commercial Business Liability Insurance: A Summary of Business Liability Insurance Policies

Small Business Liability Insurance: Summary of What This Insurance Covers